Quantum Computing Is Transforming Financial Services — Here’s How

Quantum computing is transforming finance, enhancing solutions for investment strategies, risk management, and cybersecurity, helping institutions stay ahead in a data-driven world.

Quantum computing is making a growing impact across industries, and the financial sector is among those leading the way. A new report from the Global Finance & Technology Network (GFTN) (formerly Elevandi) — Quantum Computing: Unlocking New Possibilities in Financial Services — highlights how banks, regulators and tech firms are already exploring [r1] quantum technologies to solve complex problems in investment strategy, cybersecurity, and risk management.

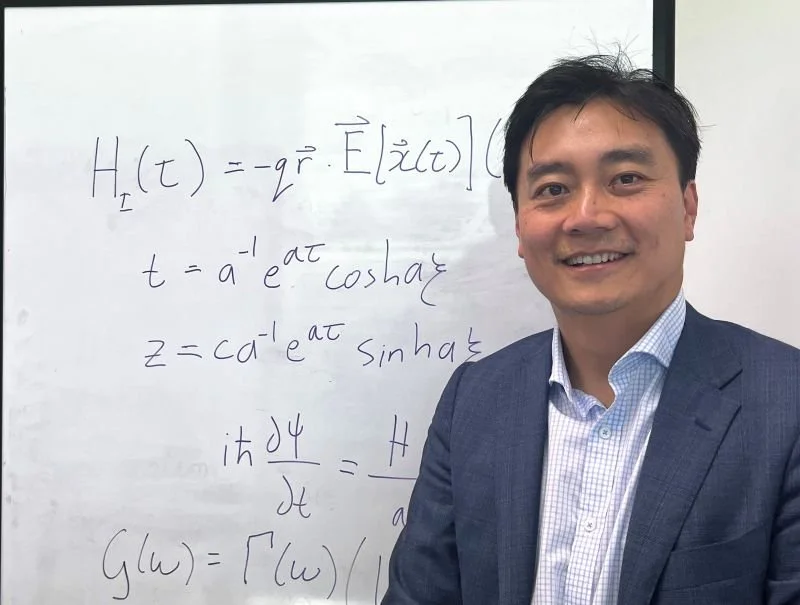

The report features a foreword by Professor Jingbo Wang, Director of the Centre for Quantum Information, Simulation and Algorithms at The University of Western Australia, who notes the transformative impact quantum computing is having across the global financial system. As financial institutions deal with ever-growing volumes of data and demand more sophisticated modelling, quantum computing is emerging as a natural fit for these high-stakes challenges.

Globally, governments and industry coalitions are working toward widespread international adoption of post-quantum cryptographic standards by 2030, aligning roadmaps and compliance efforts to safeguard global digital infrastructure. Countries such as the U.S., Spain, France and Japan are already building migration plans into national cybersecurity strategies, recognising the need for collective preparedness in the face of quantum threats.

What Makes Quantum Computing Different?

Quantum computing leverages principles from quantum mechanics, including superposition (where quantum bits, or qubits, can exist in multiple states at once) and entanglement (where the state of one qubit depends on another, no matter the distance), to process information in fundamentally new ways.

Unlike classical computers, which store data as binary bits (0 or 1), quantum computers use qubits that can hold a combination of 0 and 1 simultaneously. This enables quantum machines to explore many possibilities at once and solve complex problems with exponentially fewer steps.

In finance, where success often depends on solving high-dimensional stochastic differential equations and modelling outcomes across countless variables, quantum capabilities are being tested, and adopted, at increasing scale.

How Financial Services Are Using Quantum Today

The GFTN report outlines several financial applications where quantum computing is already proving valuable:

1. Portfolio Optimisation

Banks and asset managers rely on portfolio optimisation tools to balance risk and return across thousands of assets. Quantum algorithms can streamline parts of this process, delivering faster and more precise calculations that help firms respond to market shifts in real time. One key technique being enhanced by quantum computing is the Monte Carlo simulation — a method used to model the probability of numerous outcomes in financial forecasting. By accelerating these simulations, quantum computers enable more accurate scenario analysis, leading to better-informed investment strategies and risk assessments.

2. Risk Management and Credit Modelling

Quantum computing promises to transform risk management and credit modelling by dramatically speeding up complex calculations and enhancing analytical capabilities. Imagine running Monte Carlo simulations in massive quantum parallel, allowing banks to assess risks like Value-at-Risk (VaR) and credit risk with unprecedented accuracy and in near real-time. This means more precise predictions for market trends, better risk estimation and management, and ultimately, more robust financial decision-making.

3. Fraud Detection

As digital transactions and cyber threats increase, so does the demand for advanced fraud detection. Financial institutions are increasingly using AI and machine learning to identify unusual behaviour and flag potential fraud. Quantum computing can enhance these models by accelerating the training of complex machine learning algorithms, sifting through massive, diverse datasets to find hidden patterns that classical computers miss, and improving the analysis of large datasets. This allows institutions to detect fraud more quickly and with greater accuracy, especially in cases involving subtle or fast-changing patterns that traditional systems may miss.

4. Strengthening Cybersecurity with Post-Quantum Cryptography

One of the more urgent imperatives in finance is preparing for a world where today’s encryption may no longer be secure. Quantum computers are expected to crack widely used cryptographic protocols like RSA. In response, institutions are beginning to implement post-quantum cryptography, encryption methods designed to resist quantum attacks, to future-proof critical systems.

5. Protecting Payment Infrastructure

Technologies like Quantum Key Distribution (QKD) offer mathematically guaranteed security for sensitive communications, which could enhance everything from cross-border settlements to blockchain-based smart contracts. Institutions are exploring how these secure channels can be integrated into next-generation financial infrastructure.

A Fast-Moving Global Landscape

The report showcases how global financial institutions, including HSBC, JPMorgan Chase, and Deutsche Bank, are actively building quantum capabilities. Leading tech firms like IBM and Google have already demonstrated quantum milestones, and governments are accelerating investment.

Countries such as Germany, Singapore, the US and China are collectively investing tens of billions into quantum research, workforce development, and national strategies. In parallel, central banks are testing quantum-safe frameworks through collaborations like Project Leap, led by the BIS Innovation Hub.

Australia is well-positioned in this global network, with strengths in quantum hardware, software, and academic research. Initiatives across our universities and growing industry investment are already contributing to the next generation of quantum applications in finance and beyond.

Talent, Infrastructure and Investment Need to Scale

The pace of innovation is strong, but challenges remain. Quantum hardware continues to evolve, with improvements in error correction and qubit stability critical to scaling systems for widespread commercial use. Workforce development is also a key focus - McKinsey estimates only half of quantum-related roles are currently being filled, with demand set to rise sharply in the years ahead (“Five Lessons from AI on Closing Quantum’s Talent Gap Before It’s Too Late”, McKinsey, December 2022).

Encouragingly, investment in quantum is accelerating. Globally, government funding for quantum technologies has surpassed US$42 billion, with countries like China, Germany, the US and Singapore making long-term national commitments (McKinsey & Company, Quantum Technology Monitor: April 2024). In Australia, public and private investment is helping to strengthen our quantum ecosystem — from building local hardware capabilities to supporting quantum startups and foundational research.

Australia’s research community is also actively building pathways for quantum talent, and cross-sector collaboration is deepening between academia, government, and industry. Continued investment in infrastructure, education, and commercial partnerships will be key to ensuring Australia captures the full economic and strategic value of quantum technologies.

A Financial Sector Preparing for What’s Next

Quantum computing is no longer an experiment confined to the lab. Financial services leaders are integrating quantum technologies into today’s systems, not to replace existing infrastructure, but to enhance what’s possible.

Whether it's more efficient risk models, faster simulations, stronger cybersecurity, or radically improved optimisation tools, quantum is becoming part of how financial organisations prepare, predict, and protect.

Want to learn more?

Read the full report: Quantum Computing: Unlocking New Possibilities in Financial Services (GFTN, 2024)

Contact Quantum Australia

Connect with Professor Jingbo Wang

Related articles